Click to Pay

Last updated:April 30, 2025

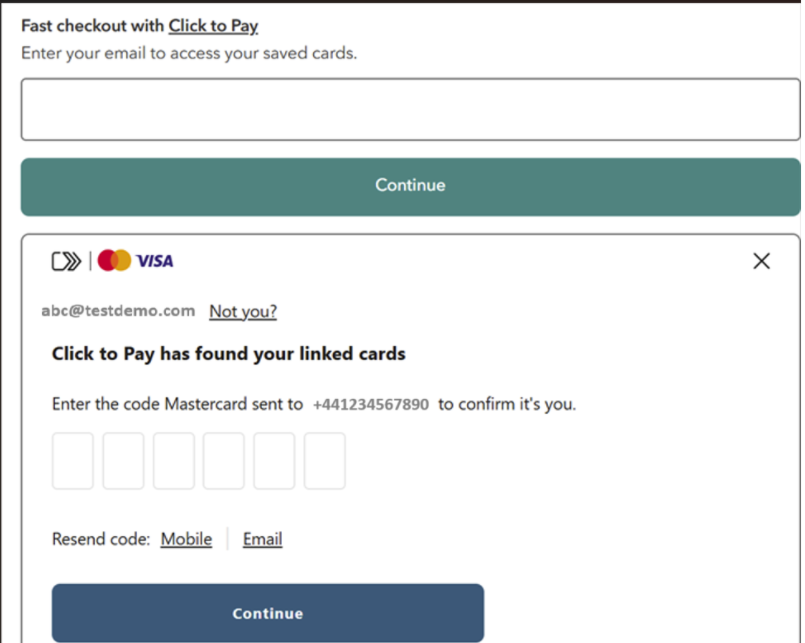

The EMV Secure Remote Commerce (SRC) enables a common consumer e-checkout that promotes simplicity, familiarity, interoperability convenience and trust. Click to Pay is a secure way to shop online without manually entering the card details or passwords. It is built on EMV standards and it provides the checkout experience that delivers the security, convenience, and control currently offered in the physical world.

Understanding Click to Pay

Click to Pay is an online payment method that allows customers to purchase items online with one click using stored payment details. It eliminates the need for customers to manually enter their payment information, which can be a cumbersome, insecure and time-consuming process. Shoppers can quickly access their preferred cards and saved details, reducing cart abandonment by letting them pay how they want. To better understand what Click to Pay is, please read the Configuration and Integration Guides.

Benefits

- Click to Pay offers Security to the Shoppers, thanks to the Tokenization: When a shopper pays using Click to Pay, the card information is turned into an encrypted Token number which is unique to that specific transaction. Also, all the transactions are authenticated using an OTP, which is more secured as compared to the regular card payments. Tokenization reduces fraud risk: It removes the need to store any sensitive info in the system, thus eliminating the risk of fraud and data breaches.

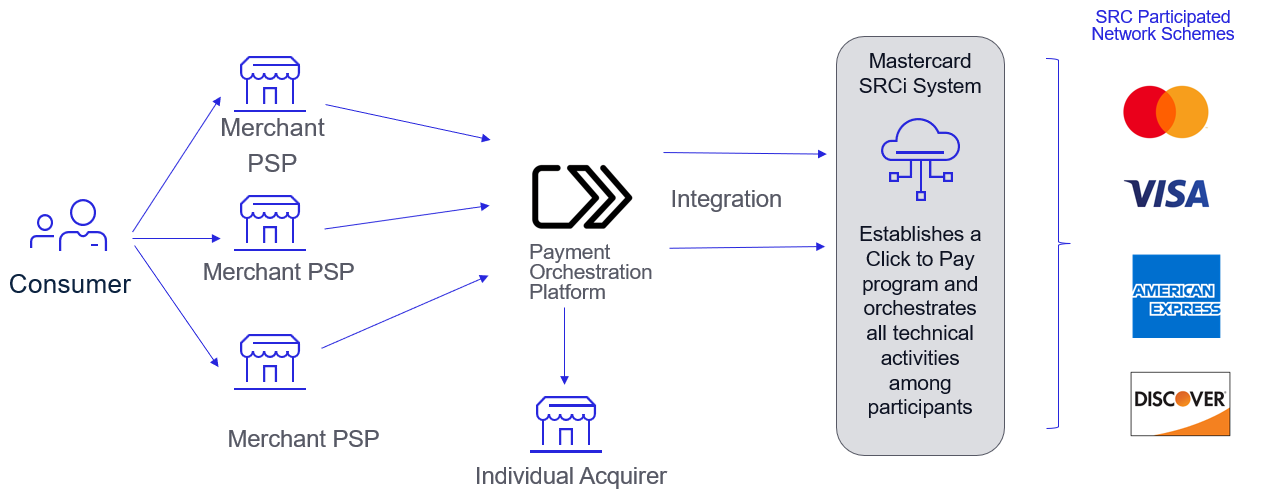

- Faster checkout and higher conversion benefits for the Shoppers: Reduces manual card entry and allows the shoppers to access their card list without typing their card details

- Reduces Cart abandonment by the Shopper as Click to Pay provides the preferred payment option and no friction in the checkout process.

- Merchants never receive the Shopper’s card information- that adds a layer of security.

- The shopper needs just one payment account of the participating schemes to pay online.

- Merchants benefit in the form of more successful transactions as it saves the Shopper’s time of manual entry.

Use Cases

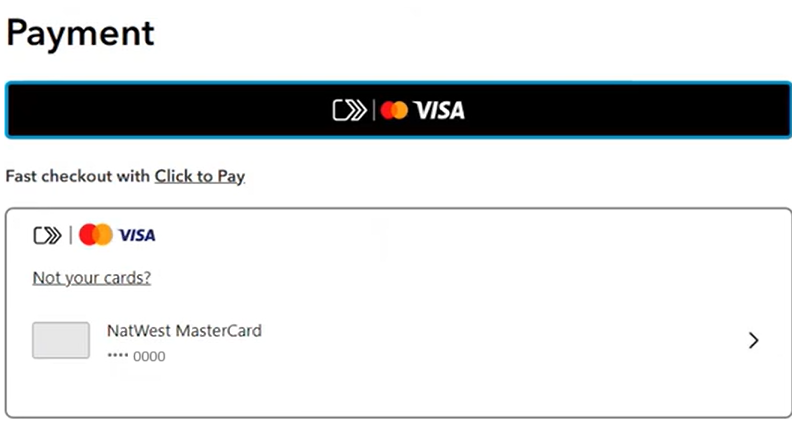

Click to Pay works for both the New/Unrecognized Shoppers and the Shoppers already having a Click to Pay profile. Here’s a guide to understand how it works for various use cases:

New User Registration

The Shopper clicks on the 'Click to Pay' checkbox on the Card widget and completes the Payment. On the click of this checkbox, Click to Pay workflow is triggered. When the payment is confirmed, TF (Token Fetch) is created. TF retrieves the Account Data from the Scheme based on the RIRO Configuration at Administration > Processing > Click to Pay Configuration. It can be Full PAN or DPAN (for Network Tokens). Once TF is completed, actual payment transaction(PA/DB) is created which goes to the Acquirer.

How it works

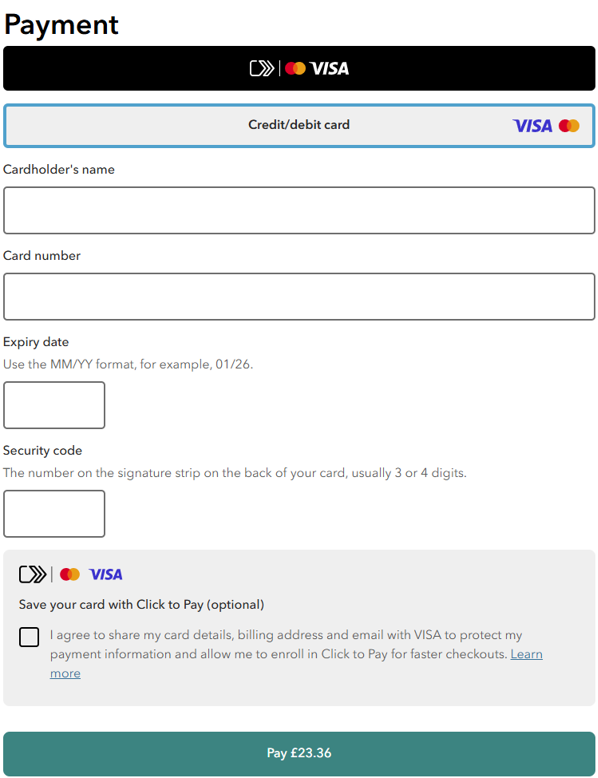

Capture the Card Details

The Shopper will be prompted to enter their card details, where they will be presented with the option to save those details via the ‘Click to Pay’ checkbox.

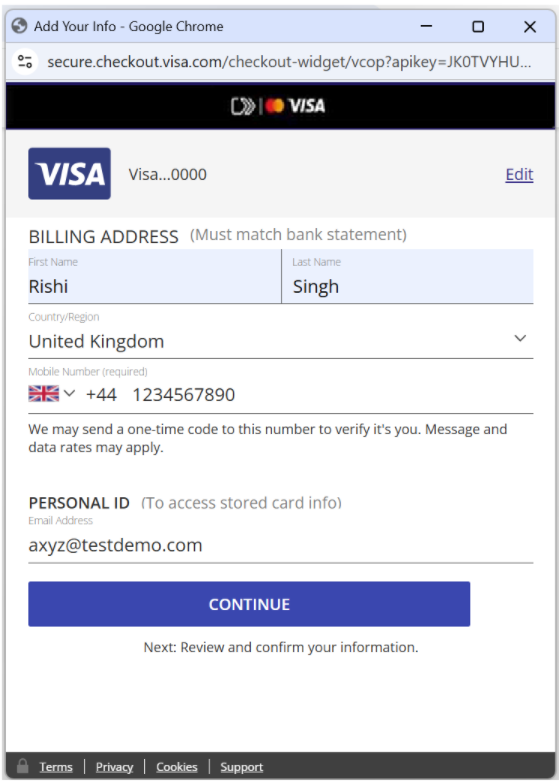

Registration on the Scheme's page

The Shopper proceeds for the Checkout on the Merchant's website and opts to pay via Credit Card. They will enter their Card details and will agree to register for 'Click to Pay' using the Checkbox on the card widget. The Shopper is then directed to the Scheme's page while doing the payment where they share their information like Name, Address, Contact Number to create their Click to Pay profile.

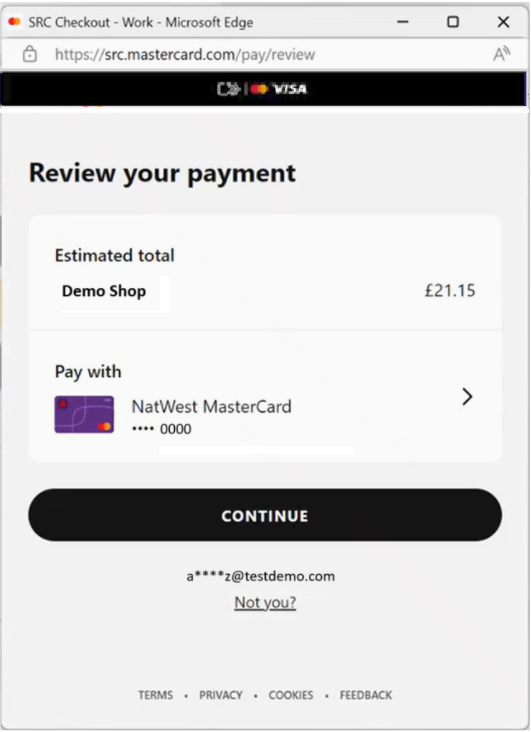

Payment Confirmation

Once the Shopper enter and register their details on the Scheme Page and proceed for payment, they are prompted to review and confirm their purchase. Click to Pay profile gets created when the Shopper completes the payment in the last step.

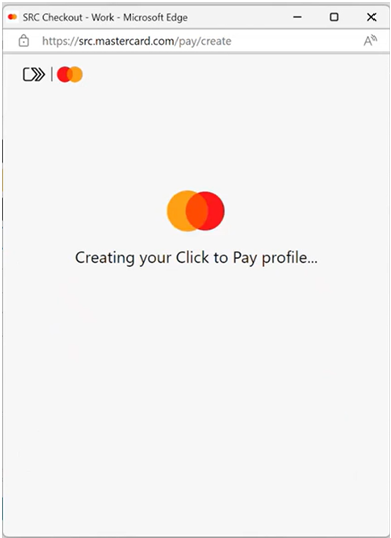

Create the 'Click to Pay' profile

Click to Pay profile gets created when the Shopper reviews and completes the payment in the last step.

Payment Response

Based on the configuration settings, Scheme returns Email ID, Mobile Number, Address of the Shopper and their masked Account details. If the Dynamic Data type settings indicate that the Scheme returns the Full Card details, then masked Credit card data is retrieved. If the Dynamic Data type settings indicate that the Scheme returns the Token details, then masked Network Token data is retrieved like Token Account Number, Expiry and Cryptogram. Once the Token Fetch is completed and the account data is retrieved from the Scheme , actual payment is created (PA/DB) which goes to the Acquirer.ApplePay Tokens

Imagine you run an online store that caters to a large number of Apple device users. Apple Pay Merchant Tokens (MPANs) securely link your customers’ payment cards to your business through their Apple Wallet. By using MPANs, you can offer a seamless payment experience that works across multiple devices and supports recurring transactions without being tied to any single device. This ensures that even if your customers change or lose their devices, their payment information remains accessible and secure.

Key Benefits of Using MPANs

- Multi-device continuity: Hassle-free payments across all devices.

- Device-independent recurring payments: Perfect for subscriptions or regular purchases.

- Persistent payment information: Safeguards against device loss or theft.

- Lifecycle management tools: Track token activity and revocation status.

Additional Benefits

- Enhanced Security: Apple Pay tokens replace sensitive card details with secure tokens, reducing the risk of unauthorized use. Each transaction is authorized with a one-time unique dynamic security code.

- Improved Customer Experience: Apple Pay tokens streamline the checkout process for Apple device users, allowing them to complete purchases quickly and easily using Face ID, Touch ID, or their device passcode.

- Increased Trust: Customers are more likely to trust and use a payment method that is known for its security and ease of use, potentially increasing your sales.

Types MPAN Requests

- Automatic Reload: For automatic top-ups, like adding funds to a store card.

- Recurring Payment: For subscriptions, such as monthly streaming services.

- Deferred Payment: For future payments, like booking a hotel room.

How to Get an MPAN

Follow our guidelines here. Ensure your card issuer supports MPAN generation.Example

A customer shopping on your online store using their iPhone can use Apple Pay to complete their purchase with just a touch or a glance. The Apple Pay token ensures that their card details are never shared with the merchant, providing a secure and convenient payment experience.Enhancements coming soon..

Shopper recognition via registered Mobile Number

For some merchants the Mobile Number is their preferred Customer Identifier. We already have the Shopper recognition via their registered Email Address in place. In addition to that, Shoppers will be able to access their Click to Pay profile using their registered Mobile Number as well.

Adding CVC for Click to Pay registered Cards

For a specific Region/Market there is a requirement to add CVC into Click to Pay transactions - this is for a local scheme who declines the transactions without the CVC present.

Introduction of 'Remember Me' on the OTP Screen

When a Shopper is recognized as a registered Click to Pay user, they are prompted with an OTP screen to authenticate their identity to access their list of registered Cards. Going forward, there will be a 'Remember Me' option on the OTP screen. Upon opting this, the Shopper will get recognized in the future transactions.

Display Click to Pay loader on the 'Review Payment' screen

During the last step of the payment, the Shopper is presented with the screen to confirm the amount of the transaction and the card with which it is being paid. This step forces the shopper to perform an action which is not needed. Hence, instead of prompting the Shopper to take action on the Review Payment screen, a Click to Pay loader will be presented.

See also

-

Click to Pay- Integration Guide (Coming Soon..)